Discover the hidden playbook to financial wellness and seize the power to transform your life and finances!

The article covers the following points:

- Financial wellness pillars

- Setting clear financial goals

- Creating a comprehensive budget

- Establishing an emergency fund

- Managing and reducing debt

In today’s fast-paced world, financial wellness has become an essential component of leading a comfortable life.

It entails managing money effectively, establishing financial goals, and making informed decisions to secure a stable financial future.

By focusing on cultivating our financial well-being, we can navigate various economic challenges, reduce stress, and achieve financial peace of mind.

We guide you through the fundamentals of financial wellness, providing valuable tips and insights to help you elevate your financial situation.

Please note that the information provided in this article is for general advice and should not be considered as personalized financial advice from a professional financial advisor.

Understanding the Concept of Financial Wellness

Financial wellness refers to the state of having a strong and stable financial foundation.

It encompasses both the ability to meet current financial obligations and the capacity to plan for the future.

Achieving financial wellness is crucial for overall life satisfaction as it allows individuals to have more control over their financial circumstances.

Financial wellness is built upon several key pillars. These include:

- Financial Literacy:

Understanding fundamental financial concepts, such as budgeting, saving, investing, and managing debt. - Financial Planning:

Setting clear financial goals and creating a roadmap to achieve them. - Financial Discipline:

Developing healthy financial habits, such as saving consistently, living within means, and avoiding unnecessary debt. - Financial Resilience:

Building an emergency fund to handle unexpected expenses and preparing for potential financial setbacks.

Building a Strong Foundation for Financial Wellness

To achieve financial wellness, it is essential to lay a strong foundation. This involves several key steps:

Setting Clear Financial Goals and Priorities

Before embarking on your financial wellness journey, take the time to identify your financial goals and priorities.

Do you want to save for a down payment on a house, pay off student loans, or build a retirement fund?

Setting clear goals helps you stay focused and motivated throughout the process.

Creating a Comprehensive Budget

A budget is a powerful tool that helps you track your income and expenses.

Start by listing all your sources of income, then track your monthly expenses.

This will give you a clear picture of where your money is going and help you identify areas where you can cut back or save.

Resource : cnbc.com A budget is the first step to financial wellness. Here’s how to get started

Establishing an Emergency Fund

An emergency fund acts as a safety net during unforeseen circumstances, such as job loss or unexpected medical expenses.

Aim to save three to six months’ worth of living expenses in a separate account for emergencies.

Managing and Reducing Debt Effectively

High levels of debt can hinder your financial wellness.

Create a plan to pay down debt systematically, starting with the highest interest rate obligations.

Consider consolidating your debts to streamline payments and potentially reduce interest rates.

Developing Smart Saving Habits

Saving money is a critical aspect of financial wellness.

It allows you to meet short- and long-term goals and provides a financial cushion for unexpected expenses.

Here are some tips to develop smart saving habits:

The Importance of Saving for Short- and Long-Term Goals

Saving is not just about setting aside money for emergencies.

It is also important to save for short-term goals, such as a vacation or a new car, as well as long-term goals like retirement.

Break down your goals into manageable amounts and set timelines to stay motivated.

Exploring Different Saving Strategies and Tools

There are numerous saving strategies and tools available to assist you in achieving your goals.

Consider opening a high-yield savings account or investing in low-risk investment vehicles like index funds or certificates of deposit (CDs).

Research different options and choose ones that align with your risk tolerance and financial goals.

Automating Savings and Practicing Mindful Spending

Automate your savings by setting up automatic transfers from your checking account to your savings account.

Designate a specific percentage or amount to save each month.

Additionally, practice mindful spending by carefully considering your purchases and distinguishing between wants and needs.

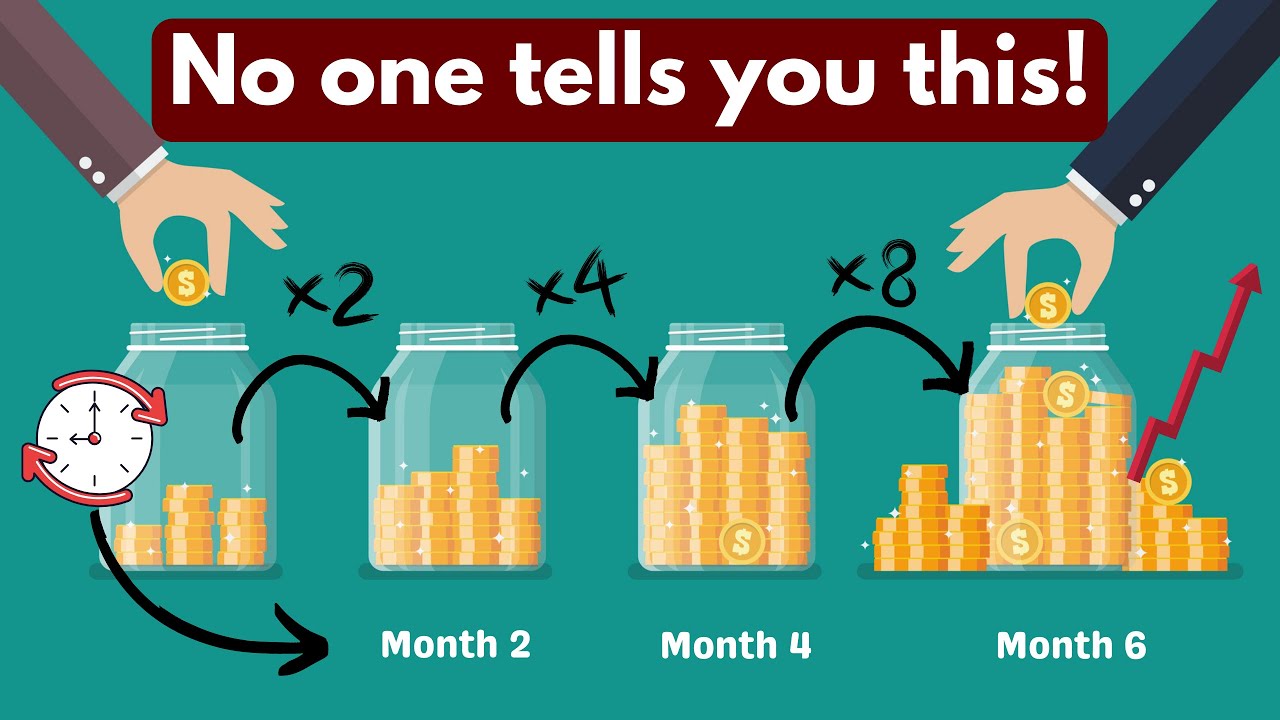

Diversifying Investments for Long-Term Financial Growth

As your financial wellness progresses, consider diversifying your investments.

This involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities.

Diversification helps mitigate risk and potentially increases long-term returns.

Navigating the World of Personal Finance

To achieve financial wellness, it is essential to navigate the world of personal finance effectively. Here are some key aspects to consider:

How To Make Financial Wellness Your Reality | Brent Hines | TEDxPleasantGrove

Watch on youtube.com : How to make financial wellness your reality

Understanding Credit Scores and Maintaining a Healthy Credit History

A good credit score is crucial for accessing favorable interest rates on loans and obtaining credit cards with lower fees.

Monitor your credit score regularly and strive to maintain a healthy credit history by paying bills on time and keeping credit utilization low.

Essential Tips for Managing Credit Cards and Loans Responsibly

Credit cards and loans can be valuable financial tools if managed responsibly.

Pay off credit card balances in full each month to avoid high interest charges.

When taking out loans, compare interest rates and loan terms and borrow only what you need.

The Significance of Insurance and Protecting Your Assets

Insurance plays a crucial role in protecting your financial well-being.

Ensure you have adequate coverage for your health, home, and vehicles.

Consider disability and life insurance policies to safeguard your family’s financial security.

Effective Strategies for Minimizing Taxes and Maximizing Returns

Minimizing tax liabilities is an essential part of financial wellness.

Maximize contributions to tax-advantaged retirement accounts and explore tax-efficient investment strategies, such as holding investments in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s.

Seeking Professional Guidance for Financial Wellness

While navigating the various aspects of financial wellness can be challenging, seeking professional guidance can provide invaluable support. Consider the following:

The Role of Financial Advisors in Crafting a Personalized Financial Plan

A certified financial advisor can help create a personalized financial plan tailored to your goals and circumstances.

They can provide guidance on investment strategies, retirement planning, and insurance needs, ensuring you stay on track to achieve financial wellness.

Identifying Trustworthy Resources for Financial Education and Guidance

There is a myriad of resources available to expand your financial knowledge.

Look for reputable websites, books, and podcasts that offer educational materials on personal finance.

Remember to verify the credibility of the sources before relying on their advice.

Building Strong Financial Literacy Skills for Long-Term Success

Continuing to improve your financial literacy is crucial for long-term financial success.

Attend workshops and seminars, join financial literacy courses, or consider pursuing certifications in financial planning to enhance your knowledge and expertise.

Conclusion

Attaining financial wellness is a journey that requires continuous learning, discipline, and practice.

By understanding the core principles and leveraging essential strategies, individuals can improve their financial well-being and enjoy a comfortable life.

Embracing financial wellness not only empowers us to achieve our dreams and aspirations but also promotes a sense of security and peace of mind.